This tale firstly gave the impression on Zacks

Sanofi SNY and spouse Regeneron REGN introduced certain top-line knowledge from the second one pivotal segment III find out about on their blockbuster drugs Dupixent (dupilumab) for treating grownup sufferers with out of control prurigo nodularis, a prolonged inflammatory pores and skin illness. The segment III PRIME find out about met its number one and all key secondary endpoints. Within the find out about, Dupixent considerably decreased itch and pores and skin lesions in comparison to placebo at 24 weeks.

– Zacks

– Zacks

Best-line knowledge from the find out about confirmed that 60% of the sufferers handled with Dupixent skilled a clinically significant relief in itch from baseline when put next with 18% of the sufferers within the placebo arm — the principle endpoint.

Additionally, 48% of the sufferers handled with Dupixent completed transparent or virtually transparent pores and skin in comparison to 18% of placebo sufferers at week 24.

Remedy with Dupixent led to seriously better enhancements in health-related high quality of lifestyles, pores and skin ache, in addition to signs of tension and melancholy. If truth be told, Dupixent is the one drugs that has proven the prospective advantage of focused on IL-4 and IL-13, central drivers of sort 2 irritation, to cut back itch and pores and skin lesions related to prurigo nodularis illness.

PRIME is the second one a success find out about on Dupixent for the prurigo nodularis indication. Sure top-line knowledge from the primary pivotal find out about have been introduced in October closing 12 months. Information from the research can be submitted to world regulatory government, beginning within the first part of 2022.

Sanofi inventory has risen 7.2% prior to now 12 months when put next with the trade’s rally of 17.5%.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

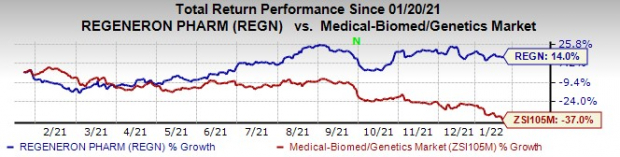

Regeneron’s inventory has risen 14% prior to now 12 months in opposition to the trade’s lower of 37%

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Dupixent is being collectively advertised through Regeneron and Sanofi beneath a world collaboration settlement. Sanofi data world web gross sales of Dupixent whilst Regeneron data its percentage of income/losses in reference to world gross sales of the drug.

Dupixent is now authorized in the US, the EU and a few different international locations for 3 sort II inflammatory sicknesses, specifically out of control power rhinosinusitis with nasal polyposis, moderate-to-severe bronchial asthma and moderate-to-severe atopic dermatitis. The widespread label enlargement approvals are using the drug’s gross sales upper.

Dupixent has turn into the important thing motive force of the highest line for Sanofi and income for Regeneron. Dupixent generated third-quarter world gross sales of $1.66 billion, that have been recorded through Sanofi. Sanofi and Regeneron also are learning dupilumab in late-stage research in a extensive vary of sicknesses pushed through sort 2 irritation like power obstructive pulmonary illness, eosinophilic esophagitis, bullous pemphigoid, power spontaneous urticaria and a few extra.

With outdoor U.S. revenues accelerating and more than one approvals for brand new indications anticipated within the close to long term, Dupixent’s gross sales are anticipated to be upper.

Sanofi these days has a Zacks Rank #5 (Robust Promote). Regeneron right now carries a Zacks Rank #2 (Purchase).

You’ll see the entire listing of lately’s Zacks #1 Rank (Robust Purchase) shares right here.

Shares to Imagine

Some huge drug/biotech shares value making an allowance for are Pfizer PFE and BioNTech BNTX, that have a Zacks Rank of one (Robust Purchase),

Pfizer’s inventory has risen 52.3% prior to now 12 months. Estimates for Pfizer’s 2022 profits have long past up from $3.86 to $5.80 over the last 60 days.

Pfizer’s profits efficiency has been blended, with the corporate exceeding profits expectancies in 3 of the closing 4 quarters whilst lacking in a single. PFE has a four-quarter profits marvel of 10.85%, on moderate.

BioNTech’s inventory has surged 64% prior to now 12 months. Estimates for BioNTech’s 2022 profits have long past up from $31.14 to $32.52 over the last 60 days.

BioNTech crowned profits estimates in each and every of the closing 4 quarters. BioNTech has a four-quarter profits marvel of 132.44%, on moderate.

(We’re reissuing this newsletter to proper a mistake. The unique article, issued on January 20, 2022, will have to not be relied upon.)

Zacks Names “Unmarried Absolute best Select to Double”

From 1000’s of shares, 5 Zacks professionals each and every have selected their favourite to skyrocket +100% or extra in months to come back. From the ones 5, Director of Analysis Sheraz Mian hand-picks one to have probably the most explosive upside of all.

As one investor put it, “curing and fighting masses of sicknesses…what will have to that marketplace be value?” This corporate may just rival or surpass different fresh Zacks’ Shares Set to Double like Boston Beer Corporate which shot up +143.0% in little greater than 9 months and NVIDIA which boomed +175.9% in three hundred and sixty five days.

Unfastened: See Our Best Inventory and four Runners Up >>

Need the most recent suggestions from Zacks Funding Analysis? These days, you’ll obtain 7 Absolute best Shares for the Subsequent 30 Days. Click on to get this unfastened document

Regeneron Prescription drugs, Inc. (REGN): Unfastened Inventory Research File

Sanofi (SNY): Unfastened Inventory Research File

Pfizer Inc. (PFE): Unfastened Inventory Research File

BioNTech SE Subsidized ADR (BNTX): Unfastened Inventory Research File

To learn this newsletter on Zacks.com click on right here.

Zacks Funding Analysis