After Storm Harvey soaked Houston with 51 inches of rain final August, Amir Befroui, a foreclosures protection specialist at Lone Famous person Criminal Assist, began making plans for an overly busy spring.

That is when the 90- and 180-day wreck on bills that loan corporations generally give house owners who’ve been hit by means of surprising occasions like herbal failures would begin to run out.

However up to now, few hurricane-related foreclosures circumstances were coming throughout his table.

“We’re beginning to see a trickle,” Befroui says. “I think it will be a gentle build up. I don’t believe it will be a tidal wave like the one who came about after Ike.”

In step with actual property analytics company Attom Information Answers, foreclosures begins in hurricane-affected spaces of Texas and Florida rose within the first quarter of 2018, however nonetheless remained beneath pre-hurricane ranges.

In Houston, for instance, foreclosures begins were quite increased because of the oil worth crash of 2015 and 2016. Now not counting a dip on the finish of 2017, the primary quarter used to be as little as it is been in additional than 12 years, with 1,184 foreclosures begins. That is a large distinction from Storm Ike in past due 2008, the place the hurricane exacerbated a mounting financial disaster that spurred 7,280 foreclosures begins in only one quarter.

Similar: Devastating hurricanes dealt company The us a significant blow

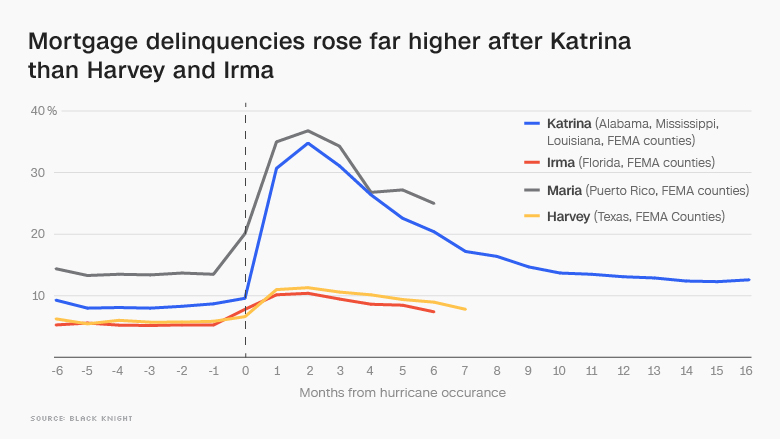

Much more encouraging, the collection of folks critically antisocial on their loans in typhoon–affected spaces of Texas and Florida persisted to sink after spiking over the iciness. 1000’s of folks have been ready to convey their mortgages present once more after profiting from post-storm forbearances from their lenders.

Given how harmful foreclosure will also be for assets values, credit score ratings and neighborhood balance, it sounds as if the Gulf Coast has controlled to dodge a doable typhoon housing disaster. A minimum of, up to now.

A part of this is because of coordinated efforts by means of business teams and client advocates who helped create higher choices for house owners to switch their loans after the wreck on loan bills ends. However extra importantly, reforms to loan insurance policies following the monetary disaster had already fostered a more fit housing marketplace initially.

House owners went into final 12 months’s failures in a greater position financially than they have been all through Hurricanes Ike, which hit in 2008, Sandy in 2012, or even Katrina in 2005. The irresponsible lending practices of the past due Nineteen Nineties and 2000s had in large part been ended by means of the Dodd-Frank Act and the Shopper Monetary Coverage Bureau, which raised requirements for loan underwriting and applied protections for debtors going through foreclosures.

“Individuals who’ve gotten mortgages post-CFPB, they do not have loans for probably the most phase that economically they might by no means have afforded,” says Ira Rheingold, govt director of the Nationwide Affiliation of Shopper Advocates.

Similar: Crisis prices jumped over 60% this 12 months to $306 billion

Throughout america, the collection of houses in lively foreclosures fell in March to the bottom stage since past due 2006, in keeping with the true property information company Black Knight.

However with regards to herbal failures, systems geared toward serving to distressed house owners don’t seem to be all the time useful sufficient. Loan amendment systems administered by means of Fannie Mae, Freddie Mac, Ginnie Mae, the Veterans Management, and the Federal Housing Management — which now again about 70% of the U.S. housing marketplace — require a number of documentation that is arduous to drag in combination if your own home is actually underwater.

House owners have been tousled in never-ending forms after Storm Sandy hit in 2012, with each and every executive housing company requiring other insurance policies and house owners owing balloon bills that got here due straight away as soon as the forbearance duration ended.

In order the 2017 typhoon season were given began in earnest, D.C.’s housing finance wonks got here to executive companies with one basic ask: Design a uniform choice that may give house owners a wreck on their mortgages with out getting them in hassle when the expenses come due.

“We have been unsuccessful all through Sandy,” says Meg Burns, a former Division of Housing and City Building reputable who now heads housing coverage on the Monetary Services and products Roundtable, which represents lenders and servicers. “That is what knowledgeable our pondering to get all the executive entities across the desk to make some constant coverage.”

In conjunction with automated forbearances for house owners in hurricane-affected spaces, Fannie, Freddie and the FHA got here up with an choice that permits debtors to make the bills they skipped all through the months after the crisis on the very finish of the mortgage — with out going thru a amendment that might pressure them to tackle the next rate of interest.

Similar: Storm-struck companies face rebuilding once more

“It is a other global now,” says Sara Singhas, affiliate regulatory recommend on the Loan Bankers Affiliation, regarding the hot departure from rock-bottom rates of interest. “Particularly for people who find themselves functioning on their loans, we would have liked to verify we do not put them right into a worse monetary place than they have been previous to the crisis.”

Those provisions, alternatively, are most effective transient and can sundown if they are not renewed. “I’d really feel significantly better in the event that they codified what we did,” says Peter Muriungi, head of loan servicing for Chase Financial institution, which had 450,000 consumers suffering from the 2017 storms.

At the floor, housing counselors say that lenders were extra prepared to paintings with individuals who can end up they’ve been a sufferer of a typhoon. That more or less endurance isn’t generally afforded to folks going through foreclosures for financial causes, corresponding to spiking assets taxes, that have develop into extra of an issue within the Houston space lately.

“The huge nationwide servicers, when they get it into their head that this can be a Harvey case, then it will get moved over to the crisis restoration middle quite than the standard foreclosures facet,” says Sherrie Younger, govt director of the Credit score Coalition in Houston.

However no longer everyone takes motion in time to obtain that more or less help, and no longer everyone qualifies after they do. For many who misplaced jobs on account of the hurricanes or have been already in the back of on their bills sooner than crisis struck, choices begin to slim.

That is why 1000’s of individuals are nonetheless going through the possibility of shedding their houses, and plenty of extra may run into that state of affairs as banks lose endurance within the coming months. Assist teams fear in regards to the individuals who have not but requested for lend a hand.

“I feel the largest downside lies with the parents who do not achieve out,” says Glenda Kizzee, a housing counselor on the Houston House City League. “They will make the most of no matter sources they’ve to rebuild the house, and on occasion omit the fee at the house, which is solely going to make it worse. Through that point, our sources are restricted in what we will be able to do.”

The largest complications, counselors say, rise up with smaller servicers that experience fewer sources to paintings with house owners in hassle.

Take Maurine Howard, whose stately house close to Addicks and Barker reservoirs in Houston used to be inundated when the Military Corps of Engineers launched the floodgates in an effort to keep away from a breach. She paid off the 3 months of loan bills after her forbearance ended, however the loan corporate nonetheless bumped up her per thirty days fee from about $1,350 to $1,700.

Months of telephone calls, she says, nonetheless have not controlled to mend the issue, whilst she racks up bank card debt to make fixes at the area.

“During the means of Harvey, coping with the loan corporate has been a nightmare,” Howard says, amid stacks of paper laid out on a mattress in one of the vital few undamaged rooms of the home. “It is by no means finishing. You’re taking two steps ahead and 5 steps again.”

CNNMoney (New York) First revealed April 22, 2018: 10:09 AM ET