With regards to making an investment in actual property for non permanent leases, like Airbnb, numbers and statistics topic. In case you’re an investor and also you’re significantly making an allowance for changing into an Airbnb host, a part of your due diligence is to search for the up to date and maximum correct Airbnb stats on your potential marketplace.

Vital Airbnb Stats and Different Issues Actual Property Traders Want to Know

Airbnb call for has because it was once established in 2008. It has turn into a well-liked staple within the non permanent condominium marketplace and has grown into an enormous empire all over the world. It has democratized actual property to the purpose that any one who has a spare bed room could make some more money by way of renting it out to transients. Tens of millions of house and belongings house owners international have jumped at the bandwagon. And even if the coronavirus pandemic hit it exhausting and made bookings move down 85%, it pressed on and overcame the demanding situations introduced by way of the well being disaster. As shuttle restrictions had been eased, the selection of bookings has began selecting up and is frequently regaining its misplaced momentum.

At this time, there are a minimum of 150 million Airbnb visitors and customers in just about 8 million houses indexed on Airbnb which can be run by way of 4 million hosts. In simply 12 brief years, Airbnb has turn into a billion-dollar business with thousands and thousands making the most of it.

With massive numbers like that, it comes as no marvel that critical actual property buyers are surroundings their points of interest on condominium houses to develop into Airbnb houses.

What’s Airbnb Making an investment?

It’s no secret to buyers as of late that there’s some huge cash to be comprised of condominium houses. The Airbnb listings expansion is a big indicator of ways winning the trade is. And seeing how profitable an business it’s, buyers need to get a work of that motion.

Through this, we will be able to outline Airbnb making an investment as a technique the place buyers acquire actual property houses for the only real goal of getting them indexed on Airbnb. Not like conventional leases, an Airbnb funding technique generates higher source of revenue for the valuables house owners, particularly in markets the place the occupancy price could be very top. Those Airbnb condominium stats will also be accessed on on-line platforms that accumulate, prepare, and analyze all varieties of Airbnb stats to provide buyers a extra complete figuring out of the native markets they’re making an allowance for.

One such platform that provides buyers a holistic perception into non permanent condominium belongings information is Mashvisor. From Airbnb expansion statistics to attainable ROI in line with marketplace, buyers have get admission to to the entire essential information they want to make the most productive conceivable actual property funding selections.

Take a look at Mashvisor to join a 7-day loose trial and notice how simple belongings location and information research will also be.

Why Must Traders Believe Airbnb Making an investment?

With billions of greenbacks below its title, thousands and thousands of houses indexed, and masses of thousands and thousands of customers, it will be a folly for an investor to reject the theory of Airbnb making an investment with out having a look at the advantages it provides. Listed below are only a few of them:

Passive source of revenue

Airbnb and different non permanent condominium platforms have higher in recognition over the last decade. This merely implies that belongings house owners have extra alternatives to generate a excellent and secure supply of passive source of revenue. Whilst purchasing a belongings isn’t precisely reasonable, an Airbnb go back on funding comes at a quicker price in comparison to renting out a area long-term.

Extra profitable in comparison to conventional leases

Since house owners can fee visitors extra in line with night time, an Airbnb condominium can generate a larger benefit in comparison to a standard long-term condominium. Taking into account the pandemic and the way it affected the business in 2020, Airbnb introduced per 30 days remains with out the yearly condominium settlement as a part of its efforts in serving to hosts and belongings house owners keep afloat right through the global disaster. In reality, in spite of the pandemic, the typical nightly price in america in 2020 went over $200.

In line with Airbnb stats by way of town, the highest 10 towns with the best possible gross revenues in 2020 are:

- Los Angeles, California – $199,310,099

- Paris, France – $196,580,195

- San Diego, California – $186,245,421

- New York Town, New York – $175,838,796

- Kissimmee, Florida – $146,486,070

- Sydney, Australia – $133,529,933

- Austin, Texas – $101,826,943

- Giant Endure Lake, California – $99,568,556

- Las Vegas, Nevada – $95,260,438

- Miami, Florida – $91,681,796

Can be utilized for their very own functions

Whoever stated you’ll be able to’t combine trade with excitement? Proudly owning an Airbnb condominium belongings doesn’t precisely imply that it will have to be used completely for that goal. House owners have the privilege of the usage of their houses as holiday properties is likely one of the perks of operating an Airbnb condominium trade. After all, private schedule will have to by no means get in the way in which of industrial however house owners can block off positive dates on their trade calendar so they are able to use their houses for after they take their much-needed and well-merited vacays.

Extra numerous tenant portfolio

Whilst conventional leases supply some sense of higher balance the place per 30 days source of revenue is concerned, finishing up with a nasty tenant (person who doesn’t make bills on time or is horrible at house repairs) will also be relatively a headache to landlords.

Then again, holiday leases, like Airbnb, give belongings house owners a extra numerous set of tenants. Whilst each and every renter contributes simplest part of your source of revenue, non permanent leases cut back the entire long-term results of unhealthy tenant problems. So long as the occupancy is top, you’ll be able to make as much as 4 occasions what one would in most cases make from conventional leases.

Higher keep an eye on over the valuables

Some of the absolute best issues about Airbnb leases is the sense of keep an eye on it offers belongings house owners and buyers. Belongings repairs is made more uncomplicated as problems that require consideration are simply and right away noticed with each and every transition and turnover. Inspections finished after each and every visitor’s keep is concluded permit hosts to spot maintenance and updates that want to be made and cope with them promptly.

House owners and hosts even have higher flexibility with pricing as they are able to simply however moderately alter their record costs on every occasion they would like. Plus, this additionally offers hosts the risk to focus on a selected form of clientele in their opting for, in contrast to maximum landlords who’re most commonly left with out a selection however to marketplace their properties to a much broader and a lot more basic inhabitants.

Whilst all of these items might appear nice, making an investment in Airbnb condominium houses additionally has some drawbacks, like:

- Upper bills and upkeep prices. Since renter turnover is way more widespread in non permanent leases like Airbnb, belongings put on and tear is considerably upper as effectively. To offer visitors with remarkable services and products and revel in, house owners will have to cope with any and all problems. On best of that, hosts additionally need to take care of positive hotel-like requirements to trap extra visitors and garner extra bookings.

- Native regulations and rules for Airbnb and non permanent leases. Each and every state, county, and town have other units of regulations and rules referring to non permanent condominium houses.

- Inconsistent source of revenue. Not like conventional leases the place house owners can be expecting a set quantity per 30 days, Airbnb condominium source of revenue varies relying at the season making your money drift very inconsistent.

- Construction a excellent rep. Beginning an Airbnb condominium trade might be just a little more difficult as discovering visitors might turn out more difficult whilst you don’t have five-star scores but. To extend their possibilities of getting extra bookings, house owners must be extra inventive with their listings and extra intentional with their advertising.

- Extra legwork. It’s the proprietor’s accountability to make sure that his or her belongings is as much as same old and is in very good situation. This implies making day by day rounds and continuously checking in with visitors.

That is why buyers will have to at all times carry out in depth due diligence in the event that they need to input this line of industrial. They want to test the numbers and do the maths to look if a belongings or marketplace is price making an investment in in line with their objectives.

Because of this, buyers will have to know which Airbnb stats actually topic so that they know if their funding will give them a excellent go back and switch in a good-looking benefit.

What Must Traders Search for?

For actual property buyers who’re enthusiastic about coming into the Airbnb condominium trade, listed below are the issues that they will have to search for:

Marketplace-Stage Knowledge Analytics

Vital Airbnb stats will also be divided into 3 primary classes. Those are Actual Property Marketplace Knowledge, Community Knowledge Analytics, and Belongings-Stage Airbnb Knowledge Analytics. Let’s move over each and every one in every of them in higher element.

Actual Property Marketplace Knowledge

Location is the secret the place Airbnb leases are involved. Traders will have to pay attention to the actual property marketplace within the county, town, or group they’re making an allowance for. Location could make or smash the trade challenge. It determines whether or not the funding will give house owners excellent returns. It signifies how a lot a belongings is, what the constraints and rules are on non permanent condominium houses, and different similar Airbnb demographics and stats.

Airbnb stats by way of town are a very powerful numbers that buyers will have to know, particularly since more than a few rules and legislations are handed in numerous towns to keep watch over Airbnb operations.

Community Knowledge Analytics

Whilst it’s vital for Airbnb buyers to find the best town, it’s similarly vital to search out the best group to spend money on. Towns are made up of various zones that provide other professionals and cons for condominium houses. Each and every group provides buyers other potentials and returns. For example, neighborhoods that experience get admission to to trade facilities, vacationer points of interest, and finding out establishments are much more likely to draw visitors whilst the ones which can be in far-flung or faraway puts is not going to have the similar good fortune price.

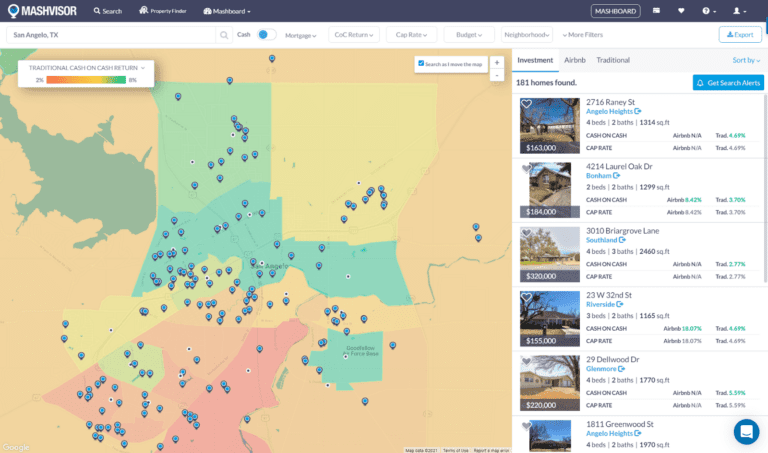

Community analytics could also be just a little trickier however thankfully, generation has made it so much more uncomplicated, because of Mashvisor’s Heatmap research device. This particular device is helping buyers analyze a couple of group information in a selected actual property marketplace. It presentations buyers the other record costs, condominium source of revenue, ROIs, and Airbnb occupancy price.

Vital Stats to Notice

Those are one of the maximum vital Airbnb stats each investor will have to know prior to deciding to head all-in:

- Collection of Airbnb listings. This knowledge states the selection of energetic Airbnb listings in a specific space. This offers buyers an concept of ways a hit a definite marketplace is for the trade in addition to how a lot festival she or he has.

- Airbnb Prices and Charges. On best of the valuables worth, those come with the opposite bills in beginning and managing the trade. Belongings repairs, utilities, taxes, belongings insurance coverage, and advertising are simply one of the few bills Airbnb trade operators incur incessantly. When surroundings nightly charges, all of those prices want to be taken into consideration.

- Airbnb Day by day Charges. That is the typical quantity that hosts fee in line with night time. This quantity is in line with the true efficiency information of Airbnb leases, often referred to as Airbnb Apartment Comparables or Airbnb Apartment Comps.

- Airbnb Per month Source of revenue. That is the typical per 30 days source of revenue an Airbnb belongings makes per 30 days in a given town. This may be in line with Airbnb Apartment Comps.

- Airbnb Money Waft. This represents the volume left from the condominium source of revenue after the bills were subtracted.

- Airbnb Occupancy Charge. This stat determines the ratio of the selection of days a belongings is occupied over the full selection of days it’s indexed at the Airbnb platform. It presentations if there’s a nice call for for holiday properties in a specific town.

- Airbnb Money on Money Go back. When computing an Airbnb go back on funding, this stat is one in every of two crucial metrics used. That is the ratio of the web working source of revenue (NOI) to the valuables’s acquire worth or present marketplace worth. That is the typical cap price generated by way of Airbnb houses in a town.

- Airbnb Apartment Comps. This can be a compilation of tangible Airbnb efficiency information in a given town. Those comparative Airbnb stats are extremely helpful when inspecting condominium houses out there which can be very similar to yours. Getting access to this makes surroundings nightly charges and figuring out the valuables’s worth more uncomplicated and quicker.

Belongings-Stage Airbnb Knowledge Analytics

At this level, you’ve most probably narrowed down your alternatives to a couple of make a choice neighborhoods. It’s now time to seek down the valuables that most nearly fits your funding profile and objectives. Through paying attention to the vital stats discussed above, buyers can now make their computations and notice if the maths exams out.

This procedure is made more uncomplicated by way of the Airbnb Benefit Calculator, additionally discovered on Mashvisor. This selection is particularly designed to assist each first-time and skilled buyers to find the most productive houses suited for their profiles and objectives.

The key is this: amassing and inspecting Airbnb stats are very important in coming into this line of industrial. For actual property buyers who’re interested by beginning an Airbnb trade, Mashvisor can assist in making the method quicker and extra handy for you. To begin searching for and inspecting the most productive funding houses on your town and group of selection, click on right here.