[ad_1]

When you’re occupied with promoting a condo belongings, you wish to have to believe a large number of issues first as a way to make a good take advantage of it. The method of marketing condo belongings may also be very intimidating, sophisticated, and overwhelming to maximum people, particularly for first-timers and noobs. If you wish to get probably the most out of it in the slightest degree annoying means, you wish to have to understand what to anticipate and get ready for every type of contingencies. ;

Now we have ready a information that will help you promote your condo belongings in the most productive and maximum delightful means conceivable.

What You Want to Know About Promoting a Condo Assets for a Benefit

There are many techniques to generate profits in actual property. When you’re an investor and you need a excellent go back on funding, actual property is nearly all the time a super street for that. Earning profits in actual property is relatively common. It’s now not a question of whether or not you’ll earn from it or now not however extra of the way a lot and how briskly will the go back be. This is the reason a large number of people wish to get into actual property making an investment.

Some of the primary techniques folks earn from actual property making an investment is through changing their houses into condo properties. Each conventional and temporary leases ensure revenue for the owner-investor. Alternatively, sure cases would possibly rise up that would possibly require house owners to promote them.

Promoting a condo belongings isn’t as simple as promoting shares or stocks. You can’t be hands-off and simply go away it to bots and AI then pass on about your day, hoping that while you get again to it, it is going to have already offered. When you personal a condo belongings and are significantly bearing in mind promoting it, listed below are the vital questions and solutions you wish to have to find out about promoting a condo belongings.

Why Will have to I Promote My Condo Assets?

Assets house owners have other the explanation why they position their condo houses on public listings. However most often, actual property traders know when it’s time to promote. Listed here are the commonest the explanation why house owners and landlords come to a decision to promote their condo houses:

Relocation

There are cases the place sure lifestyles adjustments go away belongings house owners with out a different selection however to let pass in their properties. One such case is that if the landlord wishes to transport to another town, state, or nation the place she or he can not run the condo trade. Probably the most logical factor for them to do is have the valuables indexed and take no matter cash they get from it and reinvest it in any other belongings of their new location.

Appreciation

Numerous occasions, condo belongings house owners come to a decision to promote when their investments have already generated excellent returns and simply reap the advantages as an alternative of renting it out. Buyers on this state of affairs come to a decision to simply money in at the appreciation whilst it’s nonetheless nice.

Loss

Then again, now not all houses are made equivalent. Whilst maximum do give traders a excellent go back on their funding, some are simply consuming up cash on repairs and maintenance. That is very true for properties which might be assured not to get a excellent go back within the foreseeable long run. Despite the fact that a undeniable belongings has greater than doubled in worth in simply a few years but when the maintenance will make them simply wreck even – or worse, lose cash – after a couple of years of possession, it’s easiest for house owners to let pass of them and promote whilst they’re nonetheless forward.

Tension

There are cases the place householders have determined to promote a belongings on account of the useless quantity of rigidity they’re entering into retaining and keeping up their condo houses. Possibly they had been first of all chasing numbers and feature stumbled upon sure very promising properties. However then sooner or later they begin getting issues related to the houses – unhealthy tenants, tough neighborhoods, inflation, and a number of other different components that made promoting probably the most affordable determination to make.

Will I Incur Taxes After I Promote My Condo Assets?

Benjamin Franklin, one of the crucial sensible minds all over all historical past, as soon as mentioned this: Not anything is sure excluding demise and taxes.

So the solution to this query is a convincing YES.

The taxman is all the time there ready to grasp the state’s justifiable share in all actual property transactions. There’s no means round it. As a accountable citizen, additionally it is your accountability to pay your taxes. You’re going to incur taxes which might be more than those you’ll incur promoting your circle of relatives house. The earnings from promoting a circle of relatives house aren’t taxable as much as a specific amount. When you get previous this level, your earnings at the moment are thought to be capital good points.

Taxation is other in terms of promoting a condo belongings. Any, and all benefit, created from a condo belongings sale is taxable. On most sensible of capital good points taxes, you additionally wish to get ready for depreciation recapture.

Capital Positive factors Taxes

Capital good points taxes are break up into two classes. The velocity at which you’re going to be taxed will a great deal rely on how lengthy you’ve had the asset for your ownership and portfolio.

Brief-term Capital Positive factors Tax

This kind of capital good points tax happens when the asset was once held through the landlord for not up to a 12 months. Those good points are taxed in a similar way to a standard revenue. Which means belongings house owners wish to pay the common revenue tax for his or her bracket.

Lengthy-term Capital Positive factors Tax

Then again, a long-term capital good points tax occurs when the asset has been within the proprietor’s portfolio for over a 12 months. Those good points have a extra favorable tax charge, a lot to the valuables house owners’ reduction.

Listed here are the up to date 2022 long-term capital good points tax charges from the Interior Income Carrier:

| FILING STATUS | 0% RATE | 15% RATE | 20% RATE |

| Unmarried | As much as $40,400 | $40,401 – $445,850 | Over $445,850 |

| Married submitting collectively | As much as $80,800 | $80,801 – $501,600 | Over $501,600 |

| Married submitting one at a time | As much as $40,400 | $40,401 – $250,800 | Over $250,800 |

| Head of family | As much as $54,100 | $54,101 – $473,750 | Over $473,750 |

Supply: Interior Income Services and products

On most sensible of this, without reference to whether or not they have got temporary or long-term good points, traders must additionally bear in mind that high-income taxpayers may even wish to pay an extra 3.8% internet funding revenue surtax.

Depreciation Recapture

The opposite tax that belongings house owners additionally wish to get ready for is depreciation recapture. Maximum traders know that they may be able to write off depreciation as an expense so long as they have got the asset of their portfolio.

Whilst that is all excellent and smartly, when an proprietor comes to a decision to promote the valuables, the IRS will come a-knocking to take again all that cash.

Call to mind it in relation to a standard IRA. Buyers are allowed to deduct contributions on tax returns however when they withdraw the cash, it’s now taxable.

For example, in the event you personal a belongings and feature had it for 3 years and also you write off $5,000 for depreciation every year, you’ll have to pay again $15,000 in depreciation recapture tax as soon as the valuables is offered.

You will need to word, then again, that depreciation recapture is taxed in the similar means as your common revenue tax regardless of having held the asset for greater than a 12 months. It’s because you may have already been allowed to scale back your taxable condo revenue through writing off depreciation as an expense. Moreover, the IRS computes the velocity for depreciation recapture in keeping with the allowable depreciation. Which means a belongings proprietor is matter to a depreciation recapture tax even supposing she or he hasn’t ever written any depreciation off as an expense.

How Can I Offset the Taxes From Promoting My Assets?

Even though taxes are inevitable, there are a couple of techniques to offset them to reduce the blow for your revenue.

Tax-Loss Harvesting

A variety of traders nowadays make the most of tax-loss harvesting as a method to mitigate the affect of taxes on their earnings. Buyers have discovered this strategy to be very useful because it lets them promote shedding investments to generate capital losses. They use those capital losses to offset any capital good points on their tax returns.

Whilst this technique gifts traders with a couple of nice advantages equivalent to the use of capital losses to offset a vast quantity of good points, it is very important word the next:

- This simplest applies to taxable funding accounts. Accounts like a 401k and an IRA permit people to defer on tax bills so they aren’t matter to capital good points.

- This may also be carried out to each temporary and long-term capital good points, albeit in several techniques. The sequences during which they’re carried out are other. Brief-term losses are first carried out towards temporary good points whilst long-term losses are first carried out to long-term good points and adopted through its software towards temporary good points.

You’ll want to learn up on tax-loss harvesting a little extra and visit a tax skilled for a clearer figuring out of the way it works and the way it can receive advantages you as an investor.

Change Assets

Subsequent, the IRS has sure provisions in position for actual property traders to in point of fact take pleasure in. The 1031 Trade lets in traders to defer on tax bills through “swapping” an funding belongings for any other. It necessarily lets in traders to obtain an funding belongings on a tax-deferred foundation the use of the gross sales proceeds from the former belongings. The theory this is for the reason that investor didn’t obtain any precise proceeds from the sale, there’s no revenue to tax.

That is one among actual property traders’ go-to strategies, particularly in the event that they wish to improve to a greater funding belongings with out taking any tax hits at the gross sales in their smaller houses.

Alternatively, prior to you are taking this course, you wish to have to find out about sure stipulations and laws that wish to be met, together with:

- It might simplest be used for funding property and trade;

- You simplest have 45 days to “switch” the offered belongings for the only you need to achieve;

- You’re given a length of 180 days to near at the new belongings; and

- Leftover cash after the switch is already thought to be as partial capital good points and is, due to this fact, taxable.

Incorporation Defend

Increasingly more actual property traders had been taking this course throughout the previous few years. Incorporation lets them decrease their legal responsibility and use the company as a defend to give protection to their non-public budget and property in case issues pass sideways.

To many traders, incorporation makes a large number of sense because it reduces their capital good points tax invoice considerably in addition to offers them the chance to make a super benefit thru its percentage construction.

All issues involving taxes when promoting condo belongings must be mentioned broadly with tax execs.

How Do I Promote My Condo Assets?

When you get previous all of the tax-related issues, promoting a condo belongings is lovely just like promoting a standard space. Let’s wreck the method down into more practical steps.

Step 1: Make Positive the Assets Is Vacated

If your home continues to be occupied through a tenant, you should first notify them about your determination to promote previously. Give them sufficient time to search for a spot to transport to and vacate your home. Don’t simply tell them verbally. It’s best to have it in writing in order that you’re each at the identical web page.

Step 2: Spruce It Up

If you wish to get probably the most benefit out of the sale, you’ll have to be sure that the valuables is in nice situation prior to you may have it indexed.

Paintings at the essential upkeep and updates

It’s standard for a house to want a couple of updates and upgrades because it transitions ownerships. On most sensible of the standard indicators of wear-and-tear, belongings house owners must additionally be aware of the next:

- Out of date home equipment

- Changing or solving of lighting

- Making sure a excellent operating HVAC machine

- Changing damaged or free tiles and broken ground

- Cleansing or changing worn-out carpet

- Changing or solving free doorknobs, handles, hinges, and different {hardware}

- Cleansing and repainting of each external and inside partitions

Degree it smartly

Make sure that the valuables is dressed up sufficient to offer attainable patrons a imaginative and prescient of what it is going to appear to be in the event that they are living there. A chilly and empty house simply doesn’t do a lot for a large number of people. Environment it up smartly could make it extra inviting and extremely sexy for homebuyers.

Step 3: Paintings With the Execs

All of the procedure of marketing a condo belongings is arduous and overwhelming. Thankfully, traders don’t need to do it on my own. They may be able to – and must – connect with credible and respected execs of their respective fields.

Actual property brokers, for one, can assist in making all of the procedure so much more uncomplicated since they have got an in depth figuring out of the other marketplace stipulations and tendencies. When you don’t know any native agent, you’ll all the time go browsing and seek for one.

Mashvisor is a website online that makes a speciality of actual property investments. Considered one of their options is a actual property agent listing that traders can use to hook up with the best folks, whether or not they’re purchasing or promoting.

Subsequent, in terms of house rehabilitation and renovation, it’s best to paintings with authentic contractors and repair suppliers. Running with professionals promises {that a} activity will meet business requirements. When inspection time comes, you’re going to thank your self that you made a decision to spend a couple of further greenbacks on their products and services.

Finally, make sure to visit a tax authentic for any and all tax-related issues when promoting a condo belongings. It’s all the time higher to be protected than sorry.

What Can I Do to Make Promoting My Condo Assets a Breeze?

To any person who has ever offered any condo belongings, it’s no secret that it poses sure distinctive demanding situations. Listed here are one of the issues that may make your lifestyles so much more uncomplicated if you make a decision to promote your condo house:

Paintings With Respected Native Brokers

It’s going to price a little bit further at the vendor’s finish however operating with an actual property agent offers belongings house owners larger get entry to to a much wider marketplace.

Steer clear of Promoting Long term Bookings

Additional revenue is all the time welcome however we recommend towards promoting your long run bookings to attainable patrons. Maximum traders favor houses which might be in a position to be rented out to new tenants.

Worth Accordingly

Since actual property making an investment is most often profitable, a large number of dealers make the error of overestimating their houses and pricing means too excessive. Overpriced houses have a tendency to stick in the marketplace longer which is able to price house owners more cash ultimately.

Put money into Just right Pictures

First impressions in point of fact final. If you need your home to face out and make an enormous affect on patrons, put money into a excellent photographer to take high-resolution and professional-grade photos of it. The visible affect it creates will assist generate extra pastime for your belongings.

Use Generation to Your Merit

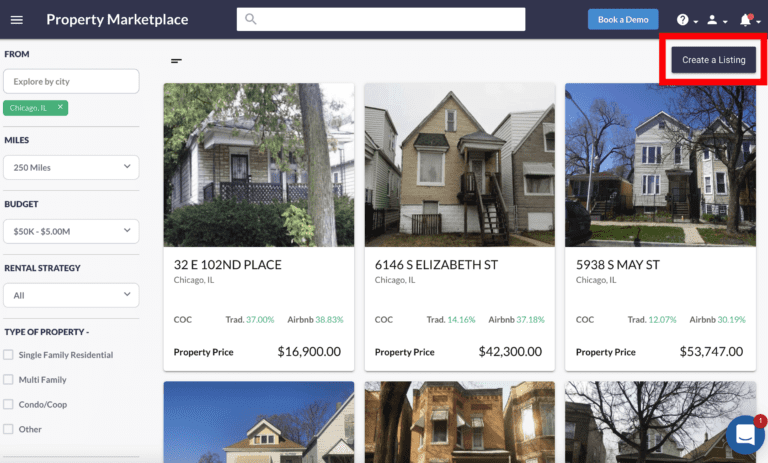

Finally, benefit from modern day era. Accumulating knowledge and inspecting information is so much sooner now, due to the web. Websites like Mashvisor permit traders to do what was once weeks’ price of analysis and research in simply mins. When you pass on Mashvisor, you’ll even discover a very vast belongings market the place you’ll in finding all kinds of listings in all corners of america.

The Mashvisor Assets Market is a precious instrument for traders to find probably the most successful houses in the freshest markets everywhere in the US. Promoting a condo belongings is straightforward the use of this instrument because it is helping dealers succeed in hundreds of attainable homebuyers, belongings managers, actual property traders, and brokers. It’s just about a one-stop store the place critical actual property traders can in finding the most productive houses, analyze funding attainable, connect to the best folks, and listing their houses.

The Backside Line

Promoting a condo belongings may also be very difficult and sophisticated however realizing what to anticipate can assist one make higher arrangements for the street forward. Know what to do, carry out your due diligence, connect to the best folks, and feature the best gear that will help you make the sale as simple as 1-2-3.

Learn our FAQs and find out about our gear. To be told extra about how Mashvisor will let you in finding successful funding houses, agenda a demo.

[ad_2]

Supply hyperlink