Satisfied New Yr buddies and buyers! What a fantastic new yr it’s prone to be. Like a bolder dropped in a pond, the virus produced an enormous implosion of company enlargement in 2020 and an remarkable explosion of enlargement in 2021. Extending the ripple-in-a-pond metaphor we would possibly be expecting that those waves will diminish in magnitude after which settle. But if and the way bumpy will the waves be in 2022? And which sector(s) will perhaps be inflicting it.

– Valuewalk

– Valuewalk

This autumn 2021 hedge fund letters, meetings and extra

Traditionally Detrimental Mixture

Complicating issues is a surge in inflation this is prone to persist thru those waves as a long time of simple cash coverage, of decrease exertions proportion of wealth/source of revenue and now the worldwide disruptions related to the virus will force costs up. That signifies that we can want to organize thru a duration of decrease enlargement and better inflation. Traditionally that could be a very adverse aggregate for asset costs.

The height of the primary wave was once glaring within the third quarter monetary statements database replace that was once simply finished. The frequency of emerging gross sales enlargement and emerging gross benefit margins was once decrease within the duration and it’s the ones frequency numbers that normally mark the expansion height.

Emerging Inflation And Pastime Charges

The one approach to shield our belongings from the adverse impact of emerging inflation and rates of interest is to personal accelerating corporations. Most effective emerging enlargement will supply protection in opposition to emerging rates of interest. The rebound from the virus depressed ranges ultimate yr has maximum corporations recording acceleration attributes.

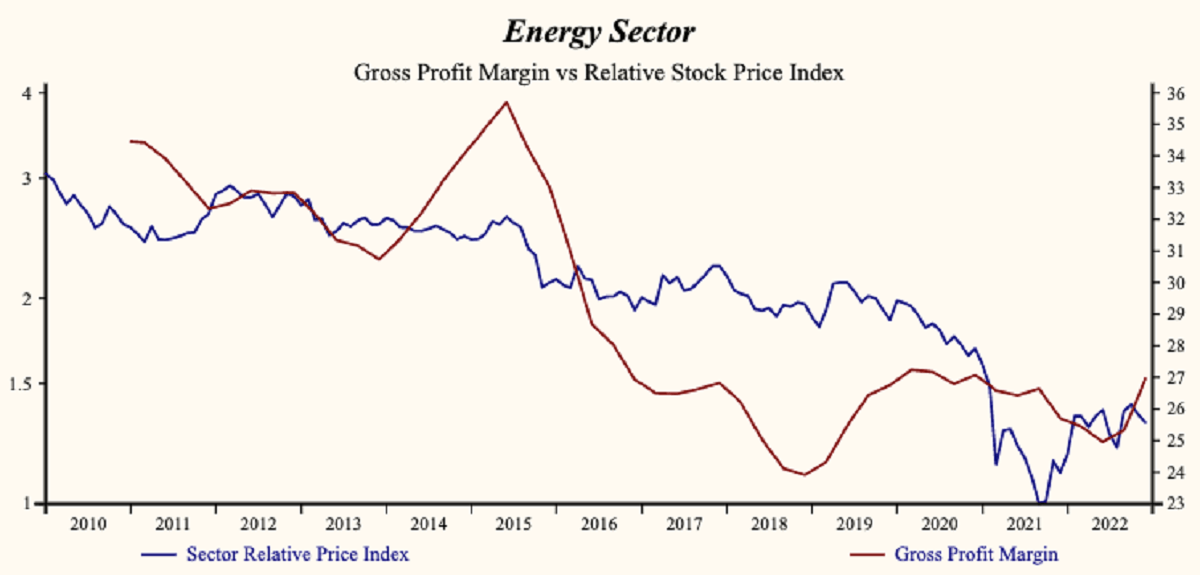

Just lately, the most important rebound was once the power crew the place gross sales enlargement dropped to -50% (on the maximum virus depressed duration) however has since recovered to 44% within the contemporary replace; with a whopping 88% of power corporations attaining an development.

Oil & Fuel Cycles

There are a number of cycles in our information file however in a regular oil and fuel cycle we’d start to see an acceleration in capital expenditures as corporations react to raised oil costs with larger exploration and building spending. Effectively carried out new initiatives would substitute fading manufacturing in different places and give a contribution to provide enlargement.

Fresh proof suggests the other is occurring within the oil and fuel trade. Capital expenditures proceed to fall relative to gross sales. Oil costs proceed to advance, manufacturing is fading however no longer being changed and provide enlargement is slowing.

Power Call for Continues To Develop

The sector isn’t prepared to cut back power use. There may be super resistance to raised oil costs and decrease fuel-cost subsidies as we’ve got observed in social unrest repeated in recent times. Most up-to-date instance in Kazakhstan.

Econ 101

From elementary financial principle, we all know that the one approach to cut back fossil gasoline use is thru upper costs. Upper power prices and carbon taxes will maintain top inflation. The new building up has lifted measured inflation via the quickest price (7%) and to the absolute best degree since 1979. The present yield on longer term bonds is two% generating an after inflation (actual) adverse go back of -5%!

Again In 1979

The ultimate time (1979) inflation was once behaving on this pattern, lengthy treasury bonds yielded 12% for an actual go back of five%. If Bond yields have been to upward push to twelve% now, the cost of lengthy treasury bonds would fall via over 80%. That is an drawing close retirement crisis.

Extraordinarily vital to retirees, please assessment your retirement accounts now and promote all fastened source of revenue securities. The one approach to shield our belongings from the adverse impact of emerging inflation and rates of interest is to possess accelerating corporations. Most effective emerging enlargement will supply protection in opposition to emerging rates of interest. The rebound from the virus depressed ranges ultimate yr has maximum corporations recording acceleration attributes.

Otos MoneyTree

Otos shows emerging gross sales enlargement and emerging benefit margins as a MoneyTree with a inexperienced globe, a gloomy trunk, and a golden pot. As corporations file their monetary statements in coming weeks, be scrupulous across the enlargement attributes of your portfolio corporations.

No matter Quantitative Gear you select to make use of, your portfolio of businesses should have emerging enlargement attributes (MoneyTree with a inexperienced globe, darkish trunk and hourglass formed golden pot).

The present Otos General Marketplace Index portfolio MoneyTree under has top and emerging gross sales enlargement, emerging benefit margins and top working/monetary leverage.

Make a selection Lively Portfolio Control and test that your portfolio attributes are, merely put, rising!

SEC Filings Of Annual Studies

That is the ultimate replace of the third quarter monetary observation replace with the Securities and Change Fee (SEC) however quickly updates from the 4th quarter year-end duration will start. Maximum corporations will quickly to be reporting their annual duration ended December. The reporting cut-off date for annual monetary statements is later so it is going to be early March earlier than we see a complete macro image (keep tuned).

All of the best possible in 2022 and take care!